What Percentage of Tips Do You Have to Claim?

I remember my first serving job vividly. I was a young, eager college student, and I was excited to make some extra money. I quickly learned that tips were a big part of the job, and I was determined to make as much as I could. But I also knew that I had to report my tips to the IRS, and I wasn’t sure how much I had to claim.

After some research, I found out that the IRS requires you to report all of your tips, regardless of how much you make. This means that you can’t just keep the cash tips you receive. You have to report them to your employer, and your employer will report them to the IRS. You will then be taxed on the tips you earn, just like you are taxed on your regular wages.

The Tip Reporting Process

The tip reporting process is designed to ensure that all tipped employees are paying their fair share of taxes. If you don’t report your tips, you could be subject to penalties and interest. The IRS has several methods for tracking tips, including:

- Tip reporting forms: Employers are required to provide their tipped employees with tip reporting forms. These forms are used to track the amount of tips that employees receive.

- Electronic tip reporting systems: Some employers use electronic tip reporting systems to track the amount of tips that employees receive. These systems are often integrated with the employer’s payroll system.

- Customer surveys: The IRS may conduct customer surveys to estimate the amount of tips that employees receive. These surveys are used to develop industry-wide tip rates.

If you are a tipped employee, it is important to keep track of the tips you receive. You should keep a daily record of your tips, and you should report your tips to your employer on a regular basis. By following these rules, you can help to ensure that you are paying your fair share of taxes.

What Happens If You Don’t Report Your Tips?

If you don’t report your tips, you could be subject to penalties and interest. The IRS may also assess a civil penalty of up to 50% of the unreported tips. In addition, you may be required to pay back taxes on the unreported tips, plus interest.

To avoid penalties and interest, it is important to report all of your tips to your employer. You should also keep a daily record of your tips, and you should provide your employer with a copy of your tip record on a regular basis.

Tips for Reporting Your Tips

Here are some tips for reporting your tips:

- Keep a daily record of your tips. This can be done using a notebook, a spreadsheet, or a mobile app.

- Report your tips to your employer on a regular basis. The frequency of your reporting will vary depending on your employer’s policies.

- If you are using an electronic tip reporting system, make sure that you are entering your tips accurately.

- Keep a copy of your tip reporting records for your own records. This will help you to prove your income to the IRS if you are ever audited.

By following these tips, you can help to ensure that you are reporting your tips accurately and avoiding penalties and interest.

FAQs About Tip Reporting

- Q: How do I report my tips if I am a tipped employee?

- Q: What happens if I don’t report my tips?

- Q: What are some tips for reporting my tips?

- Keep a daily record of your tips.

- Report your tips to your employer on a regular basis.

- If you are using an electronic tip reporting system, make sure that you are entering your tips accurately.

- Keep a copy of your tip reporting records for your own records.

A: You should keep a daily record of your tips and report your tips to your employer on a regular basis. The frequency of your reporting will vary depending on your employer’s policies.

A: If you don’t report your tips, you could be subject to penalties and interest. The IRS may also assess a civil penalty of up to 50% of the unreported tips. In addition, you may be required to pay back taxes on the unreported tips, plus interest.

A: Here are some tips for reporting your tips:

Conclusion

Reporting your tips is an important part of being a tipped employee. By following the rules, you can help to ensure that you are paying your fair share of taxes and avoiding penalties and interest.

Are you interested in learning more about tip reporting? There are many resources available online, including the IRS website. You can also talk to your employer or a tax professional for more information.

Image: bloggingexplorer.com

Image: junglesoulcollective.com

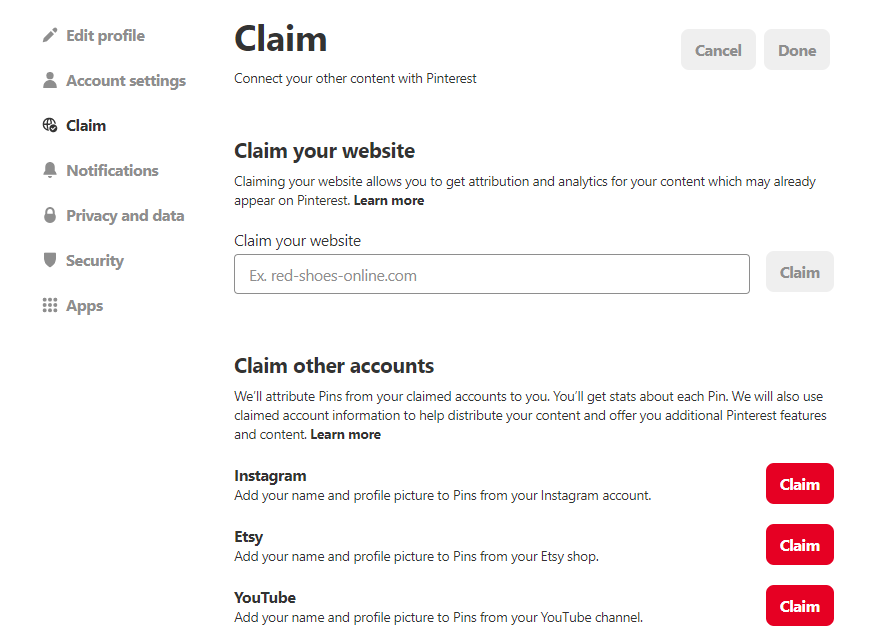

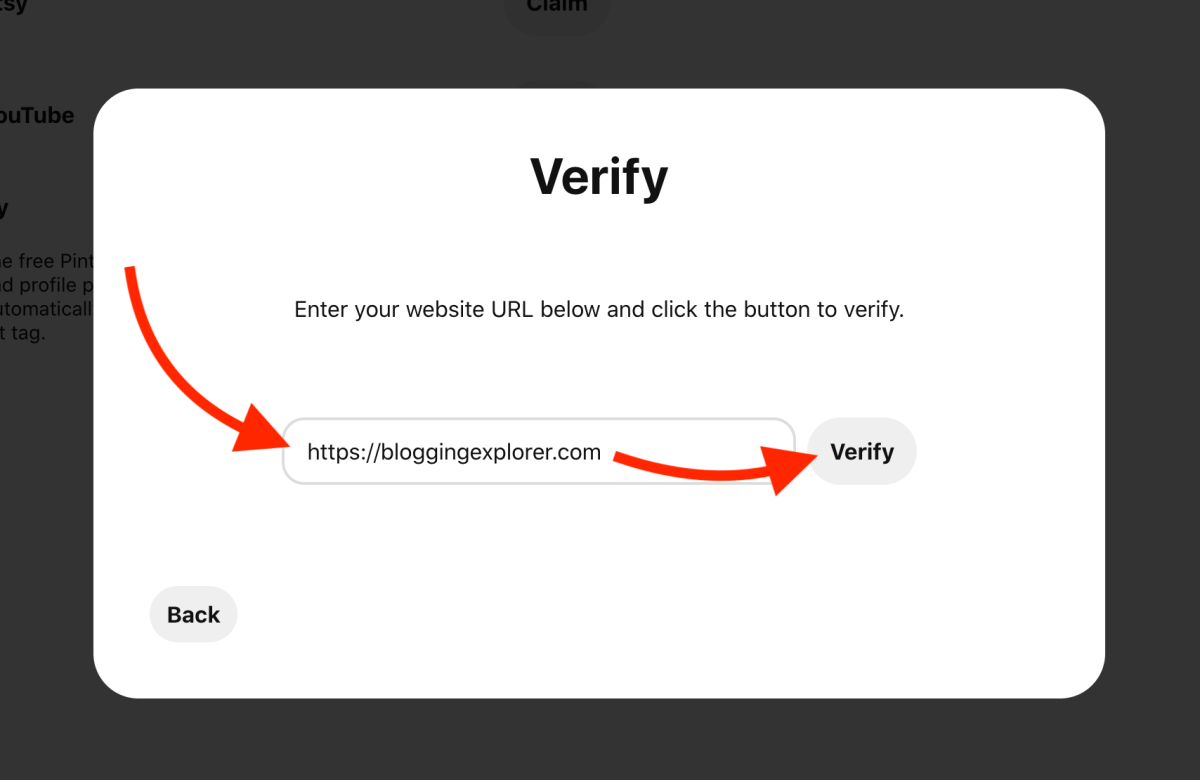

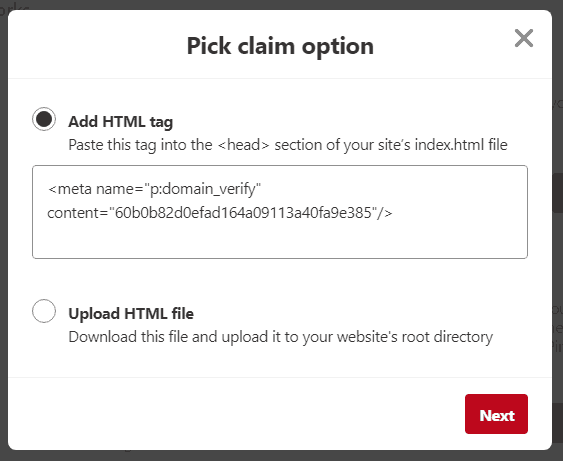

Why You Should Claim Your Instagram Account on Pinterest Jun 27, 2022June 27, 2022. 5 minutes. Pinterest is a great platform for sharing and discovering images, ideas and content. It’s also relevant for B2C marketers that want to increase engagement with their brand and analyze their audience. With Pinterest analytics tools, you can see who’s most interested in your content and how they’re interacting with it.